Shopify (NYSE:SHOP) is considered an appealing long-term investment opportunity since its recent stock price decrease post-earnings. The inventory plummeted 20% despite surpassing earnings and revenue expectations on concerns about GAAP profitability. However, upon further examination it becomes clear that this concern is unfounded and the company’s growth narrative is still intact.

Earnings Recap

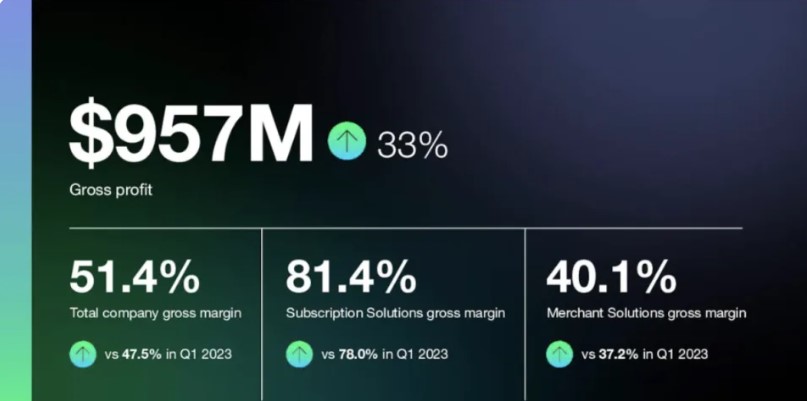

Shopify saw a strong surge in revenues at 23% or 29% excluding the shut down of its logistics arm. Merchant solutions exhibited particularly high growth rates which were in line with what was expected from them according to company guidance. Gross margin—an important measure towards achieving GAAP profitability—outperformed predictions hitting 51.40%.

Why Did The Stock Fall?

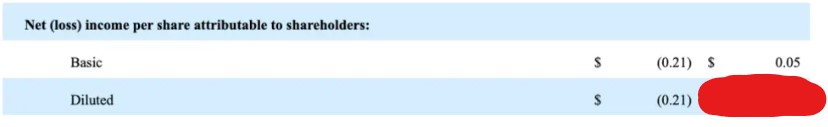

Despite positive figures as well as forecasts supporting them, there was no GAAP profit made hence causing share prices to drop massively for Shopify. The company announced that it incurred a loss of 21 cents per share during this quarter largely because it had to write-down $373M worth of equity and other investments which worried investors used to seeing only gains from high-growth stocks leading them sell off their shares.

Three Reasons To Purchase

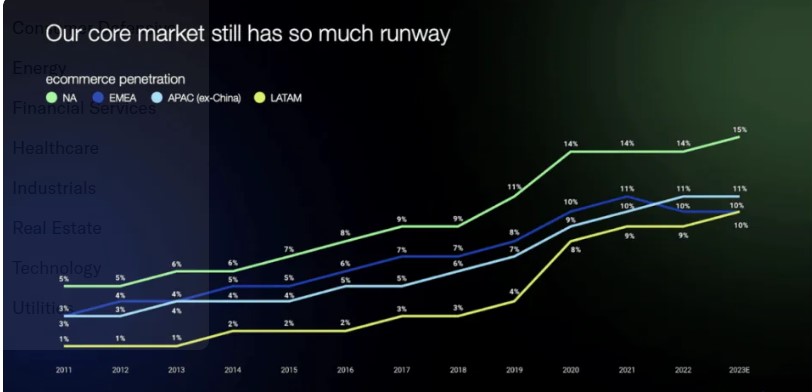

- Untapped Market Potential: Shopify has an enormous untapped global market both online and offline. The company can grow significantly by tapping into these markets where e-commerce is still nascent; such as developing countries or rural areas in developed nations.

- Path To Profitability: Shopify’s historical struggles with profitability are being addressed through strategic investments. Although technically unprofitable with these various spendings so far; it is anticipated that they will bear fruits over time frames ranging from months up to several years since Software as a Service (SaaS) platforms like Shopify’s have potential for immense earnings once established.

- Attractive Valuation: Although Shopify’s valuation metrics look high, its forward PEG ratio (five years expected) of 1.12 times the forward earnings growth rate shows that it is reasonably priced based on potential growth. Besides, the recent fall in share prices presents a chance for buying when they are discounted.

SEO Expert Challenges, SEO Job Listings Fell by 37% in the First Quarter(Opens in a new browser tab)

2024 Of Cash Flow Target Boeing Shares Decline After CFO Walks Back(Opens in a new browser tab)

Penny Stock Investing: Invest A High-Risk, High-Reward Gamble(Opens in a new browser tab)

How to avoid stock market scams in 2024, Safeguard Your Investments(Opens in a new browser tab)

Toni Kroos Germany Deutschland ist nicht mehr das Land, was es mal war

Sumeet Bagadia Top Picks: Best Stocks to Buy or Sell Today

Technical Outlook

Shopify’s technical indicators point to a good setup for a rally. The stock is at a crucial volume support area and the relative strength index (RSI) is bouncing from oversold levels with bullish divergence from the price. This could signal possible upward movement towards $200.

Conclusion

Shopify’s recent stock drop is an excellent time for entry by long-term investors. The company has strong growth prospects, a path to profitability, reasonable valuation as well as positive technicals thus making it an attractive investment opportunity. While this security is famous for its volatility, people with long-term investment horizons should take advantage of the potential gains while overlooking any downsides.