Presented by Finance Minister Nirmala Sitharaman on July 23, 2024, her seventh consecutive budget presentation. This is the first full budget of Modi government’s third term that maps out and supports Indian’s economy with a view to Viksit Bharat 2047.

Key Takeaways

The four major target groups of Union Budget 2023-24 are kept as poor, youth, women and farmers. Below are highlights:

- Estimated fiscal deficit at 4.9% of GDP for FY25

- Capex target at ₹11.11 lakh crore (3.4% of GDP)

- Allocation for agriculture sector ₹1.52 lakh crore

- PM package introduction with five employment linked schemes

- ₹3 lakh crore allocation for women related schemes

- Launch of PMAY Urban 2.0 with ₹10 lakh crore investment

Tax reforms including changes in standard deduction and capital gains tax

Strong focus on Infrastructure Development and Sustainability Initiatives

This will lead to inclusive growth, increase in employment opportunities , support for MSMEs and address key economic challenges while maintaining fiscal discipline.

Key Focus Areas & Priorities

There are four main beneficiary groups emphasized by the Union Budget 2024-25:

Poor people Youth Women Farmers With strong emphasis on employment, skilling, MSMEs and middle class this budget aims at driving inclusive growth and economic prosperity.

How does this budget differ from previous years? It places more emphasis on long-term development goals while addressing immediate economic challenges.

Fiscal Management and Economic Outlook

- Fiscal deficit estimated at 4.9% of GDP for FY25

- Capex target set at ₹11.11 lakh crore (3.4% of GDP)

- Commitment to reduce fiscal deficit below 4.5% in the coming years

India’s economic resilience is highlighted by the Finance Minister, who mentioned stable inflation and robust growth prospects. This balanced approach aims to maintain fiscal discipline while supporting economic growth.

What impact will this fiscal strategy have on India’s economic trajectory? It is expected to provide a stable foundation for sustainable growth while managing inflationary pressures.

Major Announcements and Initiatives

Boost for the Agricultural Sector

In the budget, the agricultural sector got a lot of attention with ₹1.52 lakh crore being allocated to it including:

- Minimum Support Price (MSP) fixation for farmers,

- Promotion of Natural Farming and Climate Resilient Crop Varieties,

- Introduction of Digital Public Infrastructure for Agriculture,

- Setting up of 10,000 Bio-input Resource Centres (BRCs).

These measures are intended to improve agricultural productivity, sustainability and farmer incomes. How will these initiatives revolutionize agriculture in India?

Employment and Skill Development

The budget has introduced PM Package comprising five employment linked schemes:

Employment Linked Incentive (ELI) scheme,

- Internship programs for youth;

- An allocation of ₹1.48 lakh crore has been made to education, employment and skill development;

- A target to skill 20 lakh youth over five years,

- Upgradation of 1000 Industrial Training Institutes(ITIs).

These steps aim at addressing unemployment as well as bridging the skills gap in labour force. What impact will this focus on skill development have on Indian workforce in long run?

MSME Sector Support

- For strengthening MSME sector, budget proposes:

- Enhanced Credit Guarantee Scheme with an increased corpus.

- Raising MUDRA loan limit from ₹10 lakh to ₹20 lakh.

- Introduction of self-financing guarantee fund for MSMEs.

These initiatives are meant to enhance access to credit as well as financial support to small businesses. How will this support help MSMEs compete in global market?

Women-Centric Schemes

Over ₹3 lakh crore has been allocated in the budget for women related schemes thereby underscoring government’s commitment towards empowerment and development of women.

Which specific areas will these schemes address under women’s development? The major focus is likely to be education, health care and economic empowerment.

Urban Housing Initiative

The launch of PMAY Urban 2.0 with ₹10 lakh crore investment aims to address urban housing needs and boost real estate sector.

The impact of this initiative on urban development and affordable housing availability in India’s cities will be felt in what way?

Tax Reforms

Several key changes were made to the taxation system:

Increase in the new tax regimes’ standard deduction for salaried individuals

Abolishment of angel tax for start-ups so as to promote the entrepreneurial environment

Rationalization of capital gains taxes structure

Increase in Securities Transaction Tax (STT) and Long term Capital Gains (LTCG) tax

These reforms focus on making it easier to pay taxes by simplifying tax structures, increasing investment revenue and protecting government funds. How will individual taxpayers and businesses be affected by these changes?

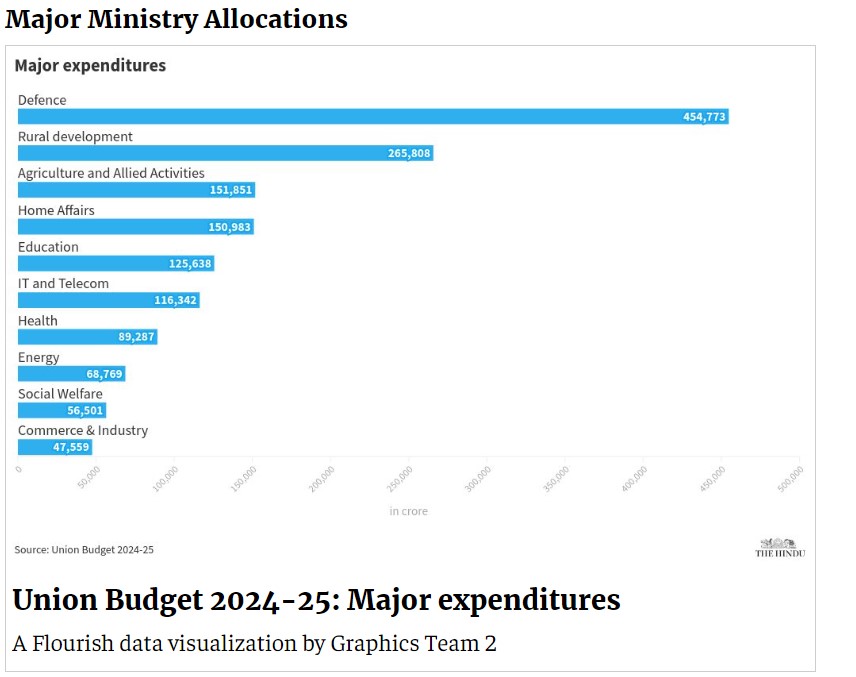

Infrastructure & Development

Infrastructure development is given priority in the budget:

Continued stress on expanding high-speed internet access.

Plans for industrial parks across 100 cities.

For instance, special packages are announced for politically critical states such as Bihar and Andhra Pradesh.

Allocation made to flood mitigation projects in Assam and other northeastern regions

These initiatives target regional disparities with a view to bridging infrastructure gaps throughout India .How does improved infrastructure contribute towards economic growth in India?

Climate Change & Sustainability

A number of measures have been introduced in this year’s budget aimed at supporting climate commitments made by India including;

Creating a taxonomy for climate finance;

Focus on reducing carbon emissions through clean energy initiatives;

Promoting green technologies and sustainable practices.

This outlines the ongoing worldwide efforts against climate change as well as GDP taken into consideration. How do you see these steps fitting within the larger picture of Indian global climate action?

Implications and Outlook

The Union Budget for 2024-25 provides an all-inclusive roadmap towards economic growth & development in India. By focusing on critical sectors of Indian economy, addressing relevant challenges, budget aims at propelling India forward towards its vision of becoming a developed nation by 2047.

The focus on inclusive growth, generating employment and the support to MSMEs and start-ups is expected to have a positive impact on the real economy. However, their success will depend on how well they are implemented and managed considering global economic challenges.

As India strides towards a $5 trillion economy, infrastructure development, digital transformation and sustainable growth that forms key focuses of the budget are seen as central factors in defining India’s future economy.

To sum up, this year’s Union Budget demonstrates the government’s balanced approach to economic growth, social welfare and long-term planning. As more information comes forward concerning its financial plans it is going to be important to watch for how these changes affect different markets and overall –Indian economy.

Kerala Lottery, Your Chance to Win in the Heart of India(Opens in a new browser tab)

Beyond Finance Houston, Your Financial Oasis in Lone Star State(Opens in a new browser tab)

Online IT Classes Your Road to Technology Triumph

FAQs

The main purpose of the state of union address is updating Congress and public about what condition country is at present time plus President’s legislative agenda along with national priorities for next year.

This means that it usually refers to online study tools or flashcards that help students learn about the history, purpose, and key aspects of the annual presidential address to Congress.

Some new initiatives introduced in 2024 budget include increased focus on climate action & sustainability measures PM Package for employment; enhanced MSME support; PMAY Urban 2.0 for housing etc.

The president’s yearly speech in front of Congress, where he provides guidance on legislation, is known as the State of the Union address. It is constitutionally mandated and a major event in America’s political year.

Targeted programs for poverty alleviation, youth empowerment, women development and agriculture are some of them while creation of employment opportunities, capacity building activities and support for MSMEs are also other ways that this budget will achieve inclusive growth.